Introduction

Diaspora remittances refer to the money transferred by individuals who have migrated from their home country to another country. These remittances serve as a lifeline for many developing nations, and Nigeria is no exception. This article explores the significance of diaspora remittances as a potential foreign direct investment (FDI) source for Nigeria. By understanding the driving factors, challenges, and opportunities associated with diaspora remittances, Nigeria can effectively harness this valuable resource for its economic growth and development.

Overview of Diaspora Remittances to Nigeria

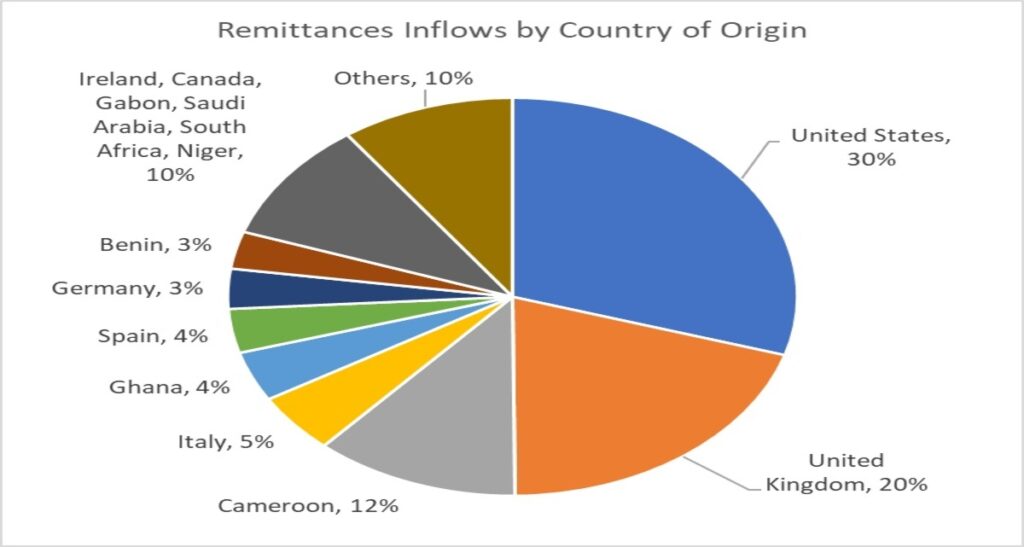

In Nigeria, remittances from citizens living abroad have become an important source of foreign exchange earnings, often exceeding foreign direct investment (FDI) and official development assistance (ODA).

In the last four years, Nigeria has seen a steady increase in the amount of diaspora remittances. According to the Central Bank of Nigeria, the country received a total of $25.08 billion in remittances in 2019, $21.45 billion in 2018, $22.1 billion in 2017, and $19.64 billion in 2016. This consistent increase in remittances is a positive sign for Nigeria’s economic development and signals the potential for increased FDI in the country.

Nigeria is one of the largest recipients of diaspora remittances in Africa. According to the World Bank, Nigeria received $24.3 billion in remittances in 2018, representing about 6% of the country’s GDP. This is a significant amount of money that can be harnessed to boost the country’s economic development, particularly in terms of FDI.

One major impact that diaspora remittances can create is around Nigeria’s overall infrastructure stock whose current position is around 30% of GDP instead of a standard 70%. To close this massive gap, Nigeria needs to invest an average of $25bn per annum infrastructure spend across all stock classes for the next 30 years – but we’re hardly generating $17bn (oil and non-oil revenues) today. This is where diaspora remittances (reported inflows by Nigeria’s CBN was about $68bn in the last 4 years) come into play.

Attract foreign direct investment of $68bn PER ANNUM through targeted campaigns showcasing infrastructure projects with potential returns and positive impacts on the economy. Simplify regulatory requirements and financing access. Partner with diaspora organizations to create a business-friendly environment that inspires confidence.

Factors Driving Diaspora Remittances

Today, several factors (mainly around black tax) drive the flow of diaspora remittances to Nigeria. Firstly, economic incentives such as higher wages and employment opportunities in host countries motivate individuals to work abroad and send money back home. Additionally, family obligations and the desire to support loved ones drive remittance transfers. Nigerian diaspora communities (estimated at 17 million globally) often prioritize sending money to their families to meet basic needs, education expenses, and healthcare costs. Furthermore, the Nigerian economy’s growth potential and investment opportunities attract diaspora individuals looking to invest their earnings back into their home country.

Challenges and Opportunities

While diaspora remittances bring significant benefits, they also face challenges. The high cost of remittance transfers, including fees charged by financial institutions, reduces the actual amount received by recipients in Nigeria. Moreover, informal remittance channels exist, which can lead to financial losses and untraceable transactions. To optimize the potential of diaspora remittances as an FDI source, Nigeria needs to address these challenges. Implementing favourable government policies and regulations, promoting transparency, and improving financial infrastructure can create opportunities to maximize the impact of remittances.

Harnessing Diaspora Remittances as a Useful FDI Source

To harness diaspora remittances as a useful FDI source, Nigeria can take several strategic steps. Firstly, strengthening the financial infrastructure is crucial – https://youtu.be/YRo62nAvdWk?si=yYjAGCwWxzrRMD-A provides a good reference. This includes reducing the cost of remittance transfers and improving the efficiency of the process. Collaboration between financial institutions, technology companies, and payment service providers can lead to the development of innovative and cost-effective remittance solutions. Embracing financial technologies like mobile money and blockchain-based platforms can streamline the remittance process, ensuring secure and transparent transactions.

Secondly, facilitating investment channels is essential. Nigeria can establish investment platforms and networks that connect remitters with viable investment opportunities. These platforms can provide information about potential projects, match investors with suitable opportunities, and offer guidance on investment processes. Collaborating with local banks and financial institutions to create investment products specifically designed for diaspora investors can further encourage their participation in FDI projects.

Creating a favourable investment climate is another key aspect. Nigeria should focus on implementing investor-friendly policies, reducing bureaucratic hurdles, and ensuring legal and regulatory frameworks that protect investors’ rights. Simplifying procedures for business registration, land acquisition, and contract enforcement can boost investor confidence. Additionally, providing incentives such as tax breaks, grants, and loan facilities targeted at diaspora investors can further enhance the investment climate.

Case studies of successful diaspora-led investments can provide valuable insights and inspiration for Nigeria. Examining examples from other countries that have effectively utilized diaspora remittances for FDI can help identify strategies and approaches that have yielded positive outcomes. India is using the diaspora funding model very successfully and Rwanda is currently developing its infrastructure in the same way.

By learning from these case studies, Nigeria can adopt best practices and tailor them to its specific context.

Conclusion

Diaspora remittances have the potential to become a useful FDI source for Nigeria. By strengthening the financial infrastructure, facilitating investment channels, creating a favorable investment climate, and learning from successful case studies, Nigeria can maximize the impact of diaspora remittances. This will not only contribute to economic growth but also foster closer ties between the diaspora community and their home country. With the right strategies and initiatives in place, Nigeria can transform diaspora remittances into a powerful engine for economic development.

FAQs

How do diaspora remittances contribute to Nigeria’s economy? Diaspora remittances contribute significantly to Nigeria’s economy by providing a stable source of foreign exchange, boosting the country’s gross domestic product (GDP), and reducing poverty levels. These funds support household income, promote consumption, and drive economic activities in various sectors.

What are the challenges faced in transferring remittances to Nigeria? Transferring remittances to Nigeria faces challenges such as high transaction costs, including fees charged by financial institutions, which reduce the amount received by recipients. Informal channels also exist, leading to untraceable transactions and potential financial losses.

How can the Nigerian government encourage diaspora investments? The Nigerian government can encourage diaspora investments by implementing investor-friendly policies, simplifying investment procedures, and providing incentives such as tax breaks, grants, and loan facilities specifically targeted at diaspora investors. Establishing platforms for engagement and offering guidance on investment opportunities can also facilitate diaspora investments.

Are there any success stories of diaspora-led investments in Nigeria? Yes, there are success stories of diaspora-led investments in Nigeria. For instance, diaspora individuals have invested in sectors such as real estate, agriculture, technology, and manufacturing, creating employment opportunities and contributing to economic growth.

What role does technology play in facilitating diaspora remittances? Technology plays a crucial role in facilitating diaspora remittances by providing innovative and cost-effective remittance solutions. Mobile money platforms, online payment systems, and blockchain technology enable secure, fast, and transparent transactions, reducing costs and improving accessibility for remitters and recipients.